The value of Assets and Liabilities undergoes a change with the passage of time due to many reasons, like regular wear and tear, appreciation in the value of assets, bankruptcy of any debtor, and so on. In the Partnership firm, whenever a partner retires, it becomes necessary to revalue the assets and reassess the liabilities of the firm to ascertain the current value of these. The Revaluation of Assets and Reassessment of Liabilities are done because of any change in the value of the assets and liabilities that belong to the period prior to the change in the profit-sharing ratio. Therefore, any increase or decrease in the value of the assets and liabilities shall be shared among all the partners in their old profit-sharing ratio. The Revaluation of Assets and Liabilities are recorded in a separate account named a Revaluation Account or Profit and loss Adjustment Account.

What is Revaluation Account?

With time it becomes essential to revise the value of the assets and liabilities to ascertain the current value of these assets and liabilities because the actual value may differ from the value mentioned in the firm’s balance sheet. This act of revising the value of the assets and liabilities is called the Revaluation of Assets and Liabilities.

Nature:

The nature of the Revaluation Account is that of a Nominal Account. Any increase in the value of assets or decrease in the value of liabilities is considered a profit for the firm. The differential amount is recorded on the credit side of the revaluation account. Similarly, any decrease in the value of assets or increase in the value of liabilities is a loss for the firm, and the differential value is debited to the revaluation account.

Explanation of certain words used in revaluation:

- Increased To/ Raised To: This means the value of the asset or liability has been increased to the adjustment amount. The value recorded in the revaluation account is the difference between the adjustment amount and the amount shown in the balance sheet, and the adjustment amount is recorded in the balance sheet.

- Increased By/ Raised By: This means the differential amount is already given in the adjustment, which is to be recorded, as it is in the revaluation account, and is added to the value of assets and liabilities in the balance sheet.

- Decreased To/ Written down To: This means the value of the asset or liability has been reduced to the adjustment amount. The difference between the adjustment amount and the amount shown in the balance sheet is shown on the correct side of the revaluation account, and the adjustment amount is recorded in the balance sheet.

- Decreased By/ Written down By: This means the differential amount is already given in the adjustment, which is to be recorded, as it is in the revaluation account, and is deducted from the value of assets and liabilities in the balance sheet.

- Valued At/ Taken At: This means the amount given in the adjustment is the value of the assets or liability. If such asset or liability is unrecorded, then the total amount of adjustment is recorded on the correct side of the revaluation account and in the balance sheet as well.

Accounting Treatment:

Whenever the assets are revalued or liabilities are reassessed, the Partners may decide to act in either of the two ways:

Case1: When assets and liabilities are shown at a revised value in the books of the firm:

The separate account titled the ‘Revaluation Account’ is opened to record the adjustments related to the revaluation of assets and liabilities. An increase in the value of the assets or a decrease in the liability is recorded on the credit side of the Revaluation Account, and any decrease in the asset or increase in the liability is debited. The unrecorded assets and liabilities are also taken into consideration. An unrecorded asset is recorded on the credit side, and an unrecorded liability, if any, is debited. Then the profit or loss, as the case may be, is transferred to the partner’s capital/current account in their old profit-sharing ratio. Both sides of the Revaluation Account are compared to determine the profit or loss. When the total of the credit side is more than the total of the debit side, the balance in the account is a profit, and the balance is a loss if the total of the debit is bigger than the total of the credit side.

Journal Entries:

1. Increase in the value of an asset:

2. Decrease in the value of an asset:

3. Increase in the value of a liability:

4. Decrease in the value of a liability:

5. Recording Unrecorded assets:

6. Recording Unrecorded Liability:

7. Transferring the balance of the Revaluation Account:

a. In case of Profit:

b. In case of Loss:

Format of Revaluation A/c:

Note: Revaluation A/c can either have a debit or credit balance.

Illustration:

Akanksha, Anamika, and Priyanshi are partners in a firm sharing their profits and losses in the ratio 3:2:5. Their Balance Sheet as at 31st March 2021 was:

On the same date, Priyanshi retired from the company, and Akanksha and Anamika decided to share their future profits and losses in the ratio of 3:2, respectively. The following adjustments were agreed upon by the partners:

- An amount of ₹2,200 included in Sundry Debtors be written off as no longer receivables.

- A Provision for Doubtful Debts to be maintained at an existing rate.

- Stock be written down by ₹2,110.

- Land & Building be written up by ₹23,000.

- Plant & Machinery be reduced to ₹68,000.

- An amount of ₹1,400 included in Sundry Creditors be written back as no longer payable.

- A Provision of ₹1,200 be made for an outstanding repair bill.

- Priyanshi’s Capital is to be transferred to her Loan Account.

Pass the necessary journal entries and prepare Revaluation A/c and Revised Balance Sheet.

Solution:

Case 2: When assets and liabilities are not shown at a revised value in the books of the firm:

Under this situation, no separate Revaluation Account is prepared, rather the Profit/Loss arising out of the revaluation of assets and reassessment of liabilities are directly adjusted through the Capital/Current Account of the Partners. In the case of the Profit on Revaluation, the Capital/Current Account of the Gaining Partner is debited, and that of Sacrificing Partner is credited. Similarly, when the Loss on Revaluation is ascertained, the Adjustment is made by debiting the Capital/Current Account of the Sacrificing Partner and crediting the Capital/Current Account of the Gaining Partner.

In order to make the above Adjustment, the following Steps are to be taken:

Step 1. Calculation of Net Effect of Revaluation:

Step 2. Calculation of share of Gain or Sacrifice by the Partners:

Share of Sacrifice = Old Ratio − New Ratio

Share of Gain = New Ratio − Old Ratio

Step 3. Calculation of Proportional share of Net Effects of Revaluation:

Share of Gaining Partner = Share of Gain × Net Effects of Revaluation

Share of Sacrificing Partner = Share of Sacrifice × Net Effects of Revaluation

Step 4. Passing Journal Entry:

A. In Case of Profit on Revaluation:

B. In Case of Loss on Revaluation:

Illustration:

Kanika, Nisha, and Shreya are partners sharing profits and losses in the ratio 4:3:2. Nisha retires from the company, and the remaining partners, Kanika and Shreya decided to share their future profits and losses in the ratio 1:1. They also decided not to record the net effect of revaluation in the books of the firm and make the adjustments directly through Capital Account. The book value and revised value of the assets and liabilities of the firm are as follows:

Make the required adjustments in the books of the company.

Solution:

Calculation of Net Effect of Revaluation:

Calculation of share of Gain or Sacrifice by the Partners:

Old ratio = 4:3:2

New Ratio = 1:1

Sacrificing Ratio/Gaining Ratio:

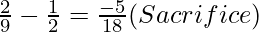

Kanika = \frac{4}{9}-\frac{1}{2}=\frac{-1}{18}(Sacrifice)

Nisha = \frac{3}{9}-0=\frac{3}{9}(Gain)

Shreya =

Calculation of Proportional share of Net Effect of Revaluation:

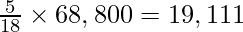

Share of Kanika (Sacrifice) = \frac{1}{18}\times{68,800}=3,822

Share of Nisha (Gain) = \frac{3}{9}\times{68,800}=22,933

Share of Shreya (Sacrifice) =

Passing Journal Entry:

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...