Accounting Treatment of Goodwill in case of Retirement of a Partner

Last Updated :

05 Apr, 2023

What is Goodwill?

Goodwill is an intangible asset that is either self-generated or purchased. It is the value of benefits that a business has because of the factors that help in increasing its profitability, say its location, favourable contracts, access to supplies and customer loyalty, etc. Goodwill is the reputation earned by the business through hard work, honesty and quality, and satisfactory services to customers. The efforts and hard work done by the existing partners frame the goodwill of the firm.

At the time of retirement or decease of partner has rightful authority and ownership in the share of goodwill. On the retirement or death of a partner, the share in the firm’s goodwill is paid by the remaining partner as compensation for their endeavour in the firm. Hence, at the time of retirement/death of a partner, goodwill is valued as per agreement among the partners. Gaining partners compensate the retiring partner for acquiring his/her share of profit after the retirement/death of a partner in their gaining ratio. If the remaining partner sacrifice along with the retiring/death of a partner, he/she shall be compensated along with the retiring/deceased partner with a share of the sacrifice made by him/her. The accounting treatment for goodwill in such a situation depends upon whether or, not goodwill already appears in the books of the firm.

Retiring Partner Share of Goodwill = Value of Goodwill on the date of retirement x Retiring partner’s share in the firm

Goodwill is adjusted by taking the following steps:

Step 1: Calculate the gaining ratio of the remaining partners.

Gaining Ratio = New Ratio – Old Ratio

Step 2: Calculate the goodwill of the firm or what is stated in the question.

Step 3: Calculate the share of goodwill of the retiring partner.

Case 1: When goodwill does not appear in the books:

The value of the firm’s goodwill is calculated, and then the share of the retiring partner in the goodwill is determined. The remaining partner’s capital account is debited in the gaining ratio, and the retiring partner’s capital a/c is credited with the share of goodwill. The following journal entry is passed:

Illustration 1:

Meena, Reena, Seema and Leena are partners sharing profit and loss in the ratio of 4:3:2:1. Leena retires from the firm. The goodwill of the firm is valued at ₹40,500 at the time of retirement of Leena. Meena, Reena, and Seema decided their future profit-sharing ratio to be 3:2:1. Pass the necessary journal entry.

Solution:

Retiring Partner Share of Goodwill = Value of Goodwill on the date of retirement x Retiring partner’s share in the firm

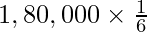

Leena’s Share of Goodwill =

= ₹4,050

Working Notes:

1. Calculation of Gaining Ratio:

2. Calculation of Seema’s sacrifice on Leena’s Retirement:

Remaining partner’s sacrifice on Retirement of a partner = Value of Goodwill x Sacrificing share

Seema’s sacrifice on Leena’s retirement =

= ₹1,350

Illustration 2:

G, H, and K are partners sharing profit and loss of the firm in the ratio of 5:4:3.H retires from the firm on 31st March, 2022. On the date of retirement of H, the firm’s goodwill is valued ₹3,72,000. G and K decided their future profit-sharing ratio to be 7:5. Pass the necessary journal entry.

Solution:

Retiring Partner Share of Goodwill = Value of Goodwill on the date of retirement x Retiring partner’s share in the firm

H’s Share of Goodwill =

= ₹1,24,000

Working Notes:

Calculation of Gaining Ratio:

Case 2: When Goodwill Account appears in the books:

When goodwill already appears in the books (i.e., it appears in the asset side of the Balance Sheet) at the time of retirement of the partner, it is written off among all the partners in the old profit-sharing ratio. The following journal entry is passed:

Illustration 1:

X, Y and Z are partners sharing profit and loss of the firm in the ratio of 2:1:1. Z retires from the firm. On the date of retirement of Z, Goodwill already appears in the book of the firm at value of ₹32,000 and Goodwill is valued at ₹96,400. X and Y decided their future profit-sharing ratio to be equal. Pass necessary journal entry.

Solution:

Retiring Partner Share of Goodwill = Value of Goodwill on the date of retirement x Retiring partner’s share in the firm

Z’s Share of Goodwill =

= ₹24,100

Working Notes:

Calculation of Gaining Ratio:

Illustration 2:

Ram, Mohan and Krishna are partners sharing profit and loss of the firm in the ratio of 1:2:3. Ram retires from the firm on 31st March, 2022. On the date of retirement of Ram, Goodwill already appears in the book of the firm at value of ₹48,000 and Goodwill is valued at ₹1,80,000. Mohan and Krishna decided their future profit-sharing ratio to be 3:2. Pass the necessary journal entry.

Solution:

Retiring Partner Share of Goodwill = Value of Goodwill on the date of retirement x Retiring partner’s share in the firm

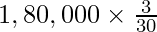

Ram’s Share of Goodwill =

= ₹30,000

Working Notes:

1. Calculation of Gaining Ratio:

2. Calculation of Krishna’s sacrifice on Ram’s Retirement:

Remaining partner’s sacrifice on Retirement of a partner = Value of Goodwill x Sacrificing share

Krishna’s sacrifice on Ram’s retirement =

= ₹18,000

Share your thoughts in the comments

Please Login to comment...