Accounting Treatment of Accumulated Profits and Reserves in case of Death of a Partner

Last Updated :

05 Apr, 2023

When the firm is reconstituted all the accumulated profit, reserves and losses are transferred to Partner’s Capital Accounts (if capital is fluctuating) or Current Accounts (if capital is fixed) in their old profit-sharing ratio. This is done because the reserves or accumulated profits/losses belong to the partners before the reconstitution of the firm (or change in profit-sharing ratio). Accumulated profit/losses, and reserves are distributed among the old partners in the old profit-sharing ratio.

Accounting Treatment of Accumulated Profits and Reserves (Journal Entries):

Case 1: When Reserves and Accumulated Profit Accounts are closed:

A. For Transfer of Reserves, Accumulated Profits etc.:

B. For Transfer of Accumulated Losses:

Illustration 1:

Rahul, Rohan, and Rajesh were partners in a firm sharing profits and losses in the ratio of 3:2:1. On 3rd March 2020, Rohan died, and the new profit-sharing ratio between the remaining partners was decided to 1:1. On the date of death, the Profit & Loss Account had a debit balance of ₹12,000, Workmen Compensation Reserve amounts to ₹20,000, and General Reserve amounted to ₹15,000. Pass the necessary Journal Entries assuming that the books of accounts are closed except Profit and Loss A/c, which was only debited to the deceased partner’s capital a/c.

Solution:

Illustration 2:

Max, Thomas, and John were partners in a firm sharing profits and losses equally. On 13th May 2021, Thomas died, and the new profit-sharing ratio between the remaining partners was decided to 4:5. On the date of death, the Profit & Loss Account had a credit balance of ₹42,000, Advertisement Expenses amounted to ₹15,000, Workmen Compensation Reserve amounts to ₹26,000, and General Reserve amounted to ₹19,000. Pass the necessary Journal Entries assuming that the books of accounts are closed.

Solution:

Case 2: When Reserves and Accumulated Profit accounts are not closed:

Illustration 1:

Sally, Sarita, and Swati were partners in a firm sharing profits and losses 3:4:5. On 25th October 2021, Sarita died, and the new profit-sharing ratio between the remaining partners was decided to 6:4. On the date of death, the Profit & Loss Account had a credit balance of ₹55,000, Advertisement Expenses amounted to ₹10,000, Workmen Compensation Reserve amounts to ₹7,000, and General Reserve amounted to ₹23,000. Pass the necessary Journal Entries assuming that the books of accounts are not closed.

Solution:

Notes to Accounts:

Accumulated Profits = Profit & Loss A/c – Advertisement Expenses + Workmen Compensation Reserve + General Reserve

= 55,000 – 10,000 + 7,000 + 23,000

= 75,000

Gaining Ratio = New Share – Old Share

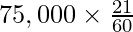

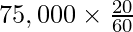

Sally will gain 21/60, and Swati will sacrifice 1/60. Hence, Sally’s Capital will be debited by 21/60th of the balance of Accumulated Profit; i.e.,  Sarita’s Capital will be credited by 20/60th of the balance of Accumulated Profit; i.e.,

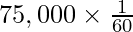

Sarita’s Capital will be credited by 20/60th of the balance of Accumulated Profit; i.e.,  and Swati’s Capital will be credited by 1/60th of the balance of Accumulated Profit; i.e.,

and Swati’s Capital will be credited by 1/60th of the balance of Accumulated Profit; i.e.,

Illustration 2:

Helen, Tom, and Sejal were partners in a firm sharing profits and losses 2:3:5. On 5th April 2021, Tom died and the new profit-sharing ratio between the remaining partners was decided to 1:1. On the date of death, the Profit & Loss Account had a debit balance of ₹33,000, Workmen Compensation Reserve amounts to ₹40,000, and General Reserve amounted to ₹58,000. Pass the necessary Journal Entries assuming that the books of accounts are not closed.

Solution:

Notes to Accounts:

Accumulated Profits = Profit & Loss A/c + Workmen Compensation Reserve + General Reserve

= (33,000) + 40,000 + 58,000

= 65,000

Gaining Ratio = New Share – Old Share

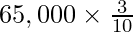

Helen will gain 3/10, Tom will sacrifice 3/10, and Swati will neither sacrifice nor gain. Hence, Helen’s Capital will be debited by 3/10th of the balance of Accumulated Profit; i.e.,  and Tom’s Capital will be credited by 3/10th of the balance of Accumulated Profit; i.e.,

and Tom’s Capital will be credited by 3/10th of the balance of Accumulated Profit; i.e.,

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...